Award-winning Private credit in Africa

Safeguarding Capital • Untapped Markets • Value Creation

-

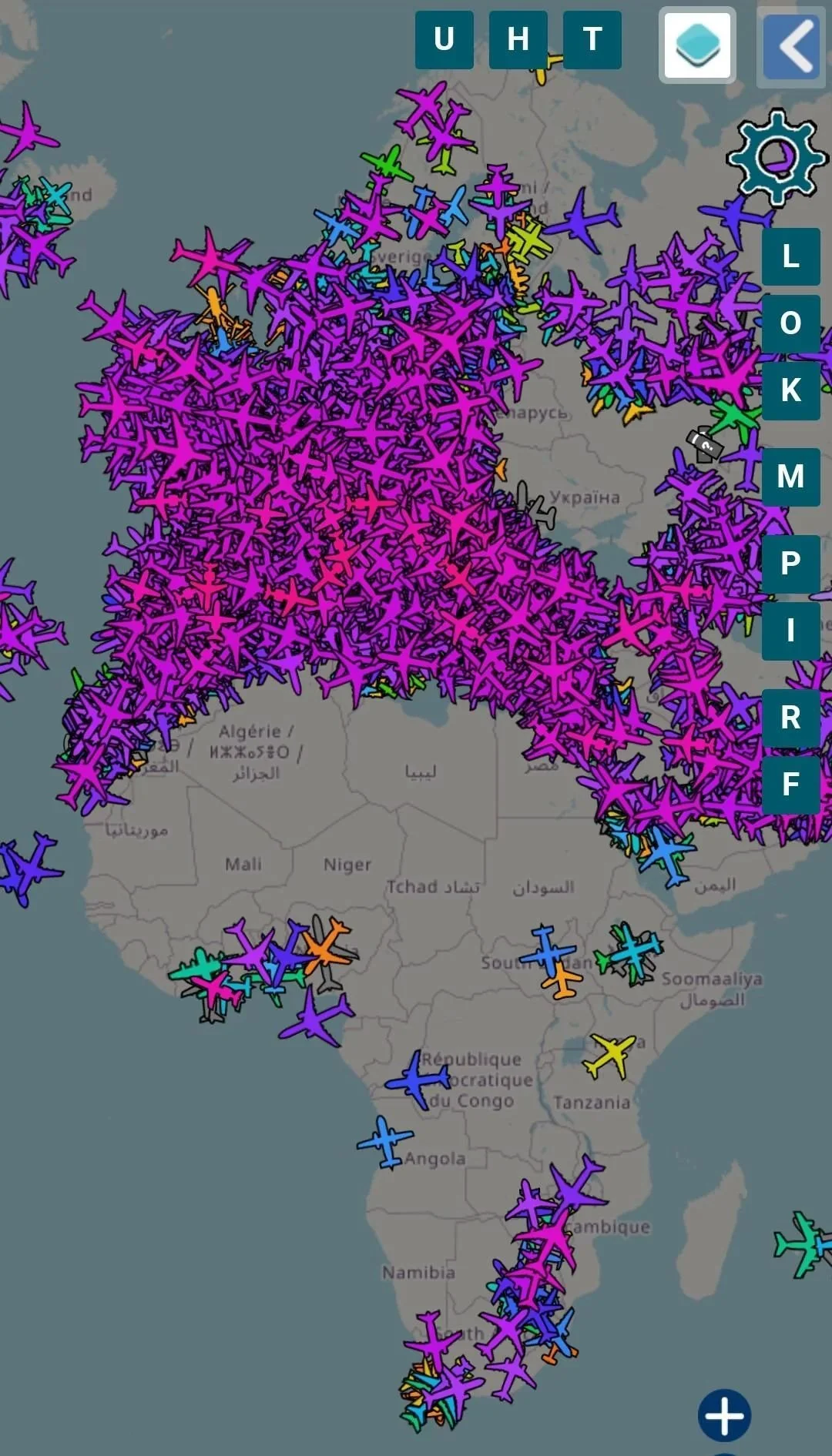

TLG Capital is a leading private credit fund manager specializing in Sub-Saharan Africa. Backed by IFC World Bank, Swedfund, Norfund, and France's public sector investment bank (Bpifrance), we have completed over 50 deals with over 30 exits in 20 African countries over the past decade.

-

We specialise in downside protection, creating bespoke structures that build on 15 years of hands-on experience of investing in Africa.

-

80% of our investments have been made in UN Least Developed Countries and World Bank Conflict-Affected Situations. These are underserved and high-potential markets where our expertise enables us to uncover compelling deals that others overlook.

-

We have strong value creation partners including UK FCDO Manufacturing Africa, McKinsey, BDO, ESS, and Ndarama. Through partners and our portfolio operations team strengthen operations, enhance environmental, social, and governance standards, and drive scalable growth.

-

Our team works across offices in Lagos, Accra, Johannesburg, Kampala, and Port Louis. This presence and local understanding helps us find great deals and build lasting partnerships across the continent.

A trusted financial partner to African business leaders since 2009

-

TLG completes landmark USD 10M private credit deal

November 2025

Partnered with International Investment Bank on a USD 10 million debt investment…

-

TLG Capital’s expansion across Africa’s private credit

November 2025

TLG Capital is expanding its Africa private credit platform…

-

Djibouti secures $10M investment from TLG Capital

November 2025

Expanding digital infrastructure and accelerating digital transformation to support SMEs.